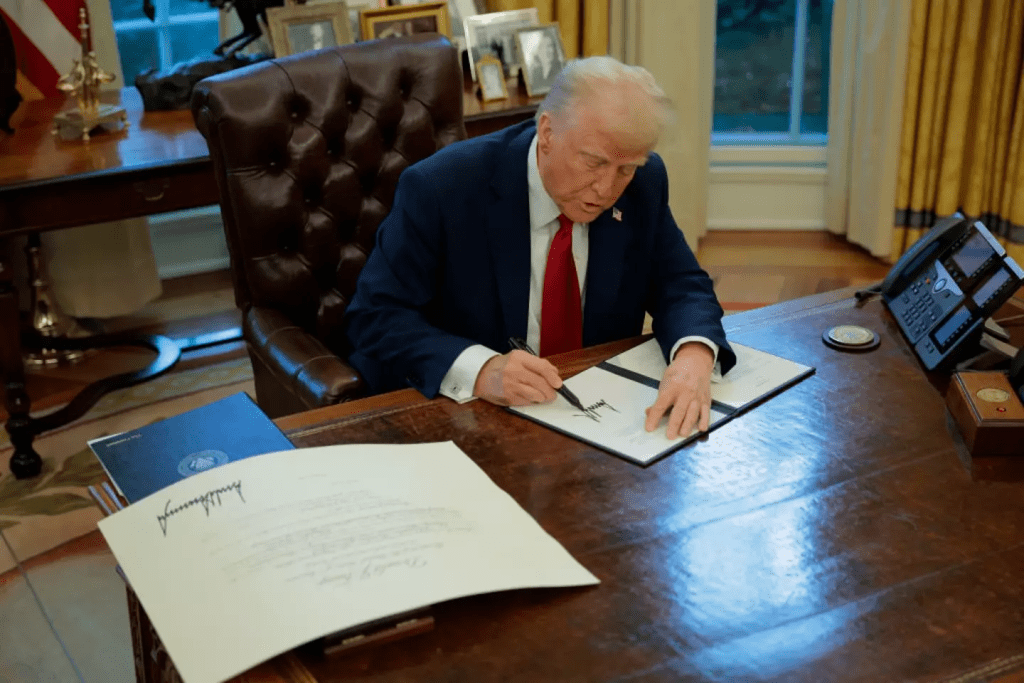

The trade war between the United States and China has reignited, with tensions escalating the moment former President Donald Trump’s tariffs took effect. This latest economic confrontation signals a new chapter in the ongoing rivalry between the world’s two largest economies.

China wasted no time in responding to Trump’s latest trade restrictions, imposing retaliatory tariffs of its own and launching an antitrust investigation into tech giant Google. With both nations now engaged in a fresh trade battle, what does this mean for the global economy and American consumers?

Let’s break down the key aspects of this escalating dispute.

Understanding Tariffs and Their Economic Impact

Tariffs are taxes imposed on imported goods, making foreign products more expensive. While they are often used as a tool to protect domestic industries, they can also trigger trade conflicts and price hikes for consumers.

Historically, tariffs have been viewed as counterproductive for developed nations. According to the Council on Foreign Relations, they typically lead to reduced trade, higher costs for consumers, and retaliation from foreign countries—a scenario that has played out between the US and China multiple times over the years.

Trump’s latest executive order targeted imports from Canada, Mexico, and China, imposing:

- 25% tariffs on goods from Canada and Mexico

- 10% tariffs on China’s shipped goods, including essential commodities like crude oil and farming equipment

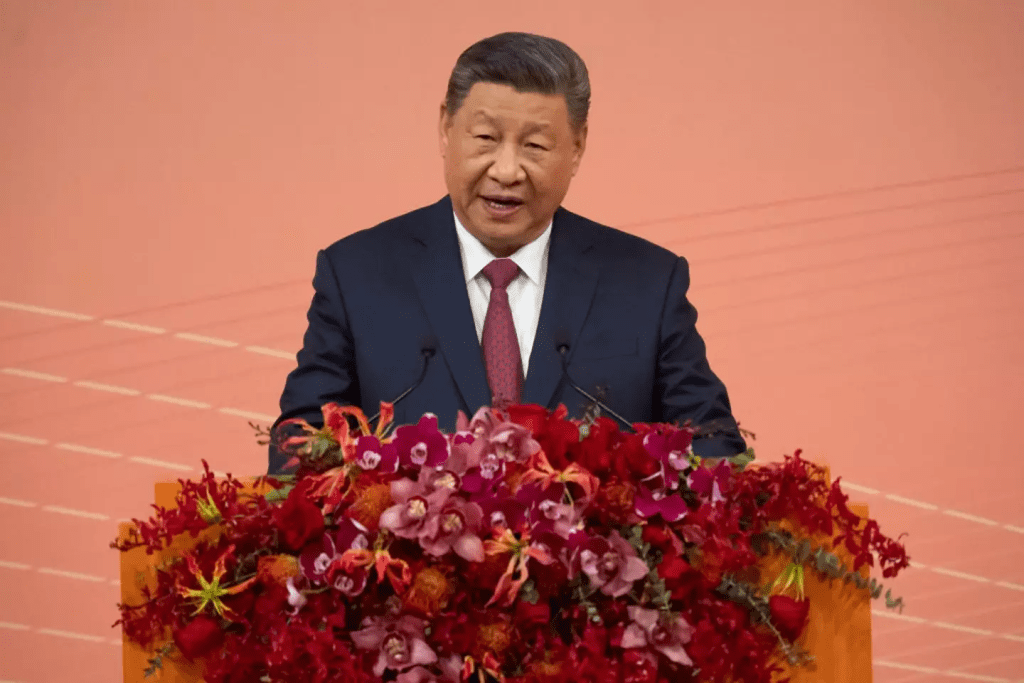

China’s response came swiftly, further fueling economic uncertainty.

China’s Immediate Retaliation to Trump’s Tariffs

Just minutes after the tariffs took effect, China’s Ministry of Finance announced a series of countermeasures, demonstrating that Beijing was fully prepared for Trump’s move.

China imposed:

- 15% tariffs on US coal and liquefied natural gas

- 10% tariffs on crude oil, farming equipment, and certain automobiles

Additionally, China took a non-tariff measure by initiating an antitrust investigation into Google, targeting the tech giant under the Anti-Monopoly Law of the People’s Republic of China.

China’s Commerce Ministry also declared new export controls on key industrial minerals, including tellurium, molybdenum, tungsten, and ruthenium, which are essential to high-tech manufacturing and defense industries.

Why Trump Imposed Tariffs on China, Canada, and Mexico

The former US president justified the tariffs by citing national security concerns, particularly regarding illegal immigration and drug trafficking.

According to Trump’s administration, China had failed to curb the illegal flow of fentanyl precursors—a major contributor to the opioid crisis in the US. Additionally, the White House accused China of engaging in intellectual property theft and forced technology transfers, prompting tariffs as a countermeasure.

Trump’s speech at the House GOP retreat in Florida further outlined his economic strategy:

- Ending federal income tax and replacing it with tariffs on foreign goods

- Using economic leverage to pressure trade partners into making security commitments

- Holding China accountable for unfair trade practices and intellectual property violations

While Canada and Mexico agreed to enhance border security efforts, leading to a suspension of tariffs on certain goods, China took a firm stand against Trump’s demands, escalating tensions further.

The Global Implications of the US-China Trade War

The latest round of tariffs has far-reaching consequences beyond the United States and China. The global economy is already under pressure due to supply chain disruptions and inflation, and a renewed trade war could worsen these issues.

Here’s what to expect:

1. Increased Costs for American Consumers

Tariffs make imported goods more expensive, and businesses often pass these costs on to consumers. This means higher prices on everyday essentials, from electronics to automobiles.

2. Supply Chain Disruptions

China’s decision to impose export restrictions on critical materials could disrupt production in the US, particularly in tech and defense industries. Many American companies rely on Chinese-sourced minerals for manufacturing.

3. Uncertainty in Global Markets

Stock markets tend to react negatively to trade wars, as investors fear economic slowdowns and unpredictability. A prolonged dispute could lead to fluctuating oil prices, currency instability, and weakened global trade relations.

4. Impact on US Energy Exports

With China imposing tariffs on US liquefied natural gas and crude oil, American energy producers may struggle to find alternative buyers, potentially hurting the energy sector.

What’s Next for the US-China Trade Relationship?

With China standing firm on its countermeasures and Trump’s administration doubling down on tariffs, diplomatic tensions are at an all-time high.

Key developments to watch include:

- China’s Google investigation – If Beijing moves forward with regulatory action, it could set a precedent for targeting US tech firms.

- Further tariff escalations – Trump could respond with additional trade restrictions, leading to a full-scale economic conflict.

- Possible negotiations – Although unlikely in the short term, both sides could eventually seek a trade truce to avoid long-term economic damage.

Final Thoughts: The Trade War Has Just Begun

The trade standoff between China and the United States is more than just a dispute over tariffs—it’s a battle for economic supremacy. With each country imposing heavy financial penalties on the other, consumers, businesses, and investors worldwide are caught in the crossfire.

The question remains: Will these tariffs achieve Trump’s intended goals, or will they further strain global trade relations? Only time will tell, but one thing is certain—the economic chess game between these two giants is far from over.